Trailing stop-loss is a risk management tool used in trading to protect profits and limit potential losses. Its crucial role lies in providing a dynamic mechanism to automatically adjust the stop-loss level as the price of an asset moves in a favorable direction. Here are the key aspects and benefits of using a trailing stop-loss:

Profit Protection:

One of the primary roles of a trailing stop-loss is to safeguard profits. As the price of an asset increases, the trailing stop-loss moves upward in tandem, ensuring that if the price reverses, the trade is exited with a profit.

Risk Reduction:

Unlike a traditional fixed stop-loss, a trailing stop adjusts itself based on the market’s movements. This adaptability allows traders to stay in a winning trade for as long as the trend persists, while still protecting against a sudden reversal.

Facilitates Trend Following:

Trailing stop-loss orders are particularly useful in trend-following strategies. They enable traders to ride the trend for as long as it lasts while providing a predefined exit point if the trend reverses.

Emotion Management:

Trading decisions based on emotions can lead to poor outcomes. Trailing stop-loss orders removes the emotional aspect of deciding when to exit a trade. This automation ensures discipline in following the trading plan.

Locking in Gains:

As the trailing stop moves with the price, it effectively “locks in” gains by continuously adjusting the exit level. This feature allows traders to participate in a significant portion of a trend while protecting the accumulated profits.

Reduces Monitoring:

Traders can use trailing stop-loss orders to reduce the need for constant monitoring of positions. Once set, the trailing stop will automatically adjust, freeing the trader from the necessity of manually managing every position.

Practical Demonstration:

A Simple Intraday Trend Following System (without a Trailing Stoploss):

In our intraday approach, we rely on a 3-minute candle chart, incorporating Pivot Points and the Relative Strength Index (RSI). Our preference lies with weekly options, specifically opting for call options with a premium of around 400.

Our buy signal is triggered when the 3-minute candle closes above the first Pivot Resistance R1, accompanied by RSI trading above 70. Our exit strategy comes into play when the candle crosses below the Supertrend line. You can visualize our strategy in the chart provided.

A Simple Intraday Trend Following System (With Trailing Stoploss):

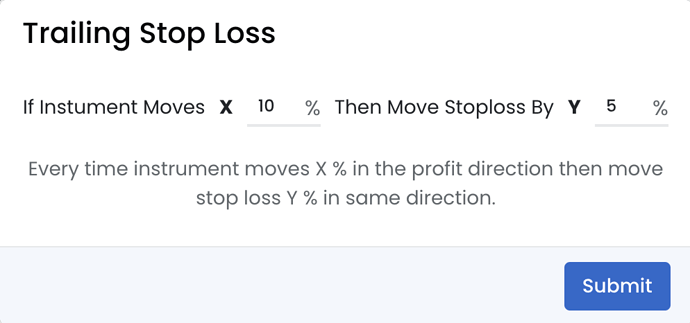

A trailing stop-loss condition (10,5) has been set to the above strategy, indicating that when the instrument experiences a 10% gain, the stop-loss will be moved by 5% in the same direction.

A trend-following system without a trailing stop-loss aims to capture the entirety of a market trend, emphasizing a longer-term perspective and accepting higher potential drawdowns.

In contrast, implementing a trailing stop-loss in a trend-following strategy introduces dynamic risk management, profit protection, and emotional discipline by automatically adjusting exit levels, thus reducing drawdowns and offering a more balanced approach to risk and reward.

Customization:

Traders can customize the distance or percentage at which the trailing stop is set from the current market price. This allows for flexibility based on the volatility of the asset and the trader’s risk tolerance.

QuantMan is one of India’s top online platforms for algorithmic trading that allows users to create, backtest, and deploy algorithmic trading strategies without any coding knowledge. It offers a variety of risk management features, including Trailing Stoploss, Move SL to Cost, Re-entry / Re-execute features, Strategy Stops, etc.

In summary, a trailing stop-loss is a powerful tool that plays a crucial role in risk management and profit protection. It helps traders maximize gains during favorable market conditions while minimizing potential losses by providing a dynamic and automated exit strategy.